How do I pay both employees and contractors?

Paying employees and paying independent contractors are pretty similar processes, but there are some key differences you need to know about as an employer.

In general, paying contractors is a lot simpler than paying employees. The thing is, the IRS considers all workers to be employees unless you can prove otherwise. And if you misclassify your workers, you could pay major penalties.

So before you do anything, take a moment to ensure you know which of your workers are actually employees and which are contractors.

TL;DR: With employees, you can control what you want them to do and how you want it done. With contractors, you don’t get to tell them how to perform the work. Here’s a more in-depth breakdown of how to tell the difference between employees and contractors.

Did you classify all your workers correctly? Good. Now, let’s get into the main things to know about paying contractors and employees.

“We really do consider Gusto to be a key business partner. We rely on their expert payroll, tax, and compliance advice from their awesome, helpful support team and Help Center articles.”

Forms you need when hiring employees vs. contractors

Before you can pay them, you need to first ask your workers to fill out some paperwork.

| Employees | Contractors |

|---|---|

| Form I-9: This verifies that your employee is eligible to work in the US. | Form W-9 or Form W-8BEN: This helps verify your contractor’s information, like their name, address, Taxpayer Identification Number (TIN), and whether they’re legally allowed to work in the US. |

| Form W-4: This helps your employee figure out their tax withholding. It also helps you calculate their income tax correctly. | |

| Your state’s W-4 equivalent (if your state charges income tax) | |

| Any benefits enrollment forms, such as those associated with 401(k) plans and health insurance |

Paying employees and contractors

Paying workers isn’t as simple as writing a check. Here’s what you need to know about paying each type of worker on your team:

Employees

When you pay employees, you typically have to pay a variety of taxes and withhold taxes from your employees’ paychecks. In general:

Both you and your employees pay:

- FICA tax, which helps pay for Social Security and Medicare

- FUTA tax, which helps fund federal unemployment insurance

- SUI tax, which helps fund state unemployment insurance

- Applicable local taxes for employers

You also pay:

Taxes aren’t the only thing that affect your team’s final paycheck—you also need to take into account elective pre-tax withholdings, voluntary and involuntary deductions, and reimbursements.

Contractors

You generally don’t have to pay payroll taxes or withhold taxes for contractors—they’re responsible for paying their own taxes.

The exception is if they’re subject to backup withholding. If your contractor doesn’t write down a valid TIN on their W-9 form, you’re required to deduct backup withholding.

This makes it pretty simple to pay contractors—you just pay them the agreed-upon amount. However, there are a couple more forms you need to know about when paying contractors: Form 1099-MISC: This tells the government how much you paid your contractor over the calendar year. You need to fill one out and file it for every contractor you:

- Paid more than $600 in a calendar year OR

- Withheld federal income tax for

Form 1096: This summarizes all your 1099 forms. You only need to submit this if you file your 1099s by mail.

Filing deadlines and recordkeeping requirements

Keeping records isn’t just a good idea in case you’re sued or audited—it’s also required for certain employment documents. Here’s what you need to know:

Employees

The Age Discrimination in Employment Act (ADEA) and Fair Labor Standards Act (FLSA) require you to keep a copy of each pay stub for at least four years. And remember those forms we mentioned earlier? They have their own filing and recordkeeping requirements too:

| Form | Requirements |

|---|---|

| Form 941 | File it by the last day of the month following the end of the quarter—i.e. April 30, July 31, October 31, and January 31 (or the next business day if any of those dates fall on a holiday or weekend). |

| I-9 | Keep it the entire time your employee works for you plus a minimum of either three years from their hire date or one year from their last day, whichever is longer. |

| W-2 | File it and give a copy to each employee by January 31. Keep it for at least four years. |

| W-4 | Keep it for a minimum of four years. |

| Federal and state payroll tax forms and tax deposit forms | Hold on to it for a minimum of four years. |

| FICA and FUTA tax forms | Keep these forms for a minimum of four years. |

On the benefits side, you should keep any records related to the Family and Medical Leave Act (FMLA) for three years and everything else (life insurance, COBRA, short-term and long-term disability insurance, retirement, health insurance, etc.) for six years.

Contractors

Since paying contractors is simpler than paying employees, it should come as no surprise that this list is shorter. But it’s just as important to keep and file these forms on time:

| Form | Requirements |

|---|---|

| 941 | Give a copy to your contractor by January 31 (or the following Monday if the 31st falls on a weekend), send a copy to the IRS by February 28 (or March 31 if you file using the IRS’s FIRE system), and keep it for at least four years. |

| W-9 | Keep it for at least four years. |

Other HR laws to keep in mind

The government has a variety of laws in place to protect workers. This is a non-exhaustive list of important laws to know about.

Employees

We’re not going to sugarcoat it… there are a lot of laws you need to follow when you have employees—more than 180, in fact. Some of the most important labor laws include:

- The Fair Labor Standards Act (FLSA), which regulates things like minimum wage, overtime pay, and child labor

- The Family and Medical Leave Act (FMLA), which requires you to provide unpaid, job-protected leave to eligible employees—if you have more than 50 employees

- The Occupational Safety and Health Act (OSHA), which regulates health and safety in the workplace

To learn more about the major labor laws, visit the Department of Labor. And don’t forget: each state has its own employment laws as well.

Contractors

There aren’t as many rules here—most laws like the FLSA only apply to employees. With contractors, your main duties are to:

- Make sure they’re actually contractors (not employees). Otherwise, you may have to pay severe penalties.

- Ask for/file/keep the appropriate forms — namely Form W-9 and 1099-MISC.

- Keep records of everything, including contracts, invoices, and proofs of payments.

How employee benefits work

Employees

While your employees would probably appreciate any benefits you can offer, you’re not required to provide most of them. Despite that, many business owners offer benefits even if they’re not required to because they know that it’s a good way to attract quality candidates and keep employees happy.

Here’s what you need to know about the top benefits employees want:

- Health insurance: You don’t have to offer health insurance unless you have 50 or more full-time equivalent (FTE) employees.

- Vacation/PTO: While FMLA requires you to provide unpaid leave to eligible employees if you have 50 or more employees, you’re not required to offer paid vacation or sick time. However, most companies do.

- Retirement plans: Unless you live in a state that requires you to offer a retirement plan, generally you’re not required to offer one. But if you do, make sure you’re following the regulations around how much your company and employees can contribute. The states that require employers to offer retirement savings plans include California, Connecticut, Illinois, Maryland, New Jersey, and Oregon.

Contractors

While you’re not required to offer benefits to independent contractors, you may be able to if you want. Providing benefits to contractors can be complicated though, so be sure to consult with a lawyer or HR expert.

While hiring employees and contractors can help your company scale, there’s a lot that goes into paying them. And the information we covered is just the starting point—states and cities have their own rules, too. It’s no wonder why small businesses paid nearly $5 billion in penalties in 2018 alone.

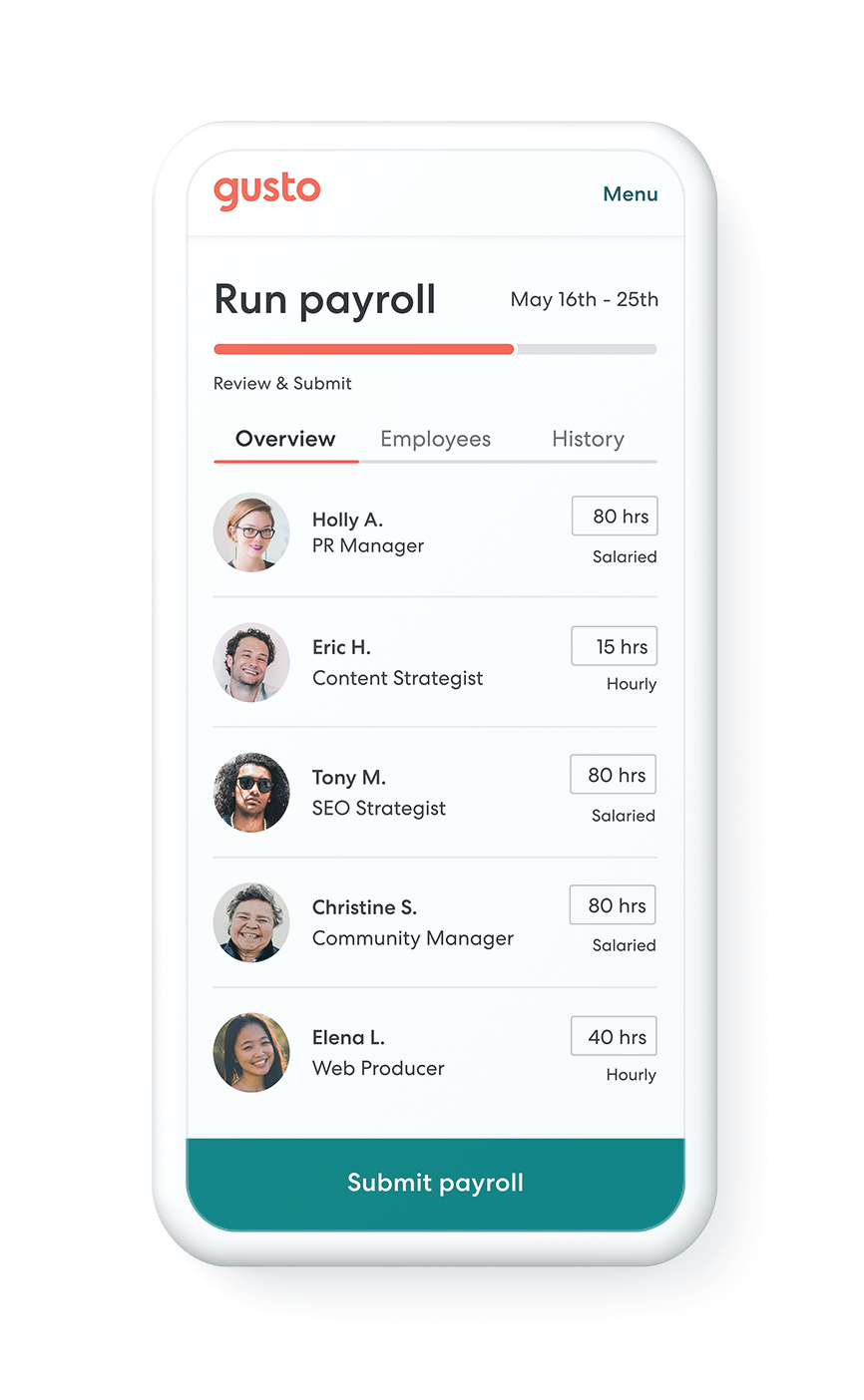

The good news is you don’t have to do this alone. With Gusto, it’s easy for small business owners to pay employees and contractors. See a demo or get started today.

“With Gusto, even my employees are impressed with how easy their new hire paperwork is!”