Nayo Carter-Gray | Published Nov 12, 2025 7 Min

Technology has made it easier for small business owners to work with contractors all over the globe. With widespread global use of electronic payments, U.S. currency can be accepted and converted by a third-party payment processor, making your small business a global enterprise with the push of a button. When you hire a contractor who does not live on U.S. soil and who is not a U.S. resident or citizen, you’ll want to send them a Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

What’s the purpose of a W-8BEN?

To stay in compliance with current IRS rules and regulations, you probably issue Form 1099 to your independent contractors who are U.S. citizens (even if they’re living abroad) or those who live in the United States and have the right to work here.

If you hired someone from a foreign country to perform services for your company, you may wonder if you are required to issue that contractor a 1099 form at the end of the year. The answer is probably no, especially if your contractor is not conducting business on U.S. soil and lives in a foreign country.

However, you are responsible for maintaining records documenting that your contractor is truly not a U.S. citizen or resident and therefore shouldn’t be issued end-of-year forms (like 1099s) or be subject to withholding tax. And that’s where the W-8BEN comes in. To ensure that your company is in compliance, you should request a completed Form W-8BEN instead of a Form W-9 from a contractor who is foreign. (You use Form W-9 for U.S. contractors.)

The W-8BEN is used to establish that your contractor is, in fact, a foreign person and, if applicable, eligible to claim a reduced rate or exemption from income tax withholding. This form is also used to establish the Chapter 3 or 4 status of the individual to avoid paying taxes on income received from certain sources, including:

- Interest (including certain original issue discount (OID));

- Dividends;

- Rents;

- Compensation for services performed;

- And more

Who should fill out a W-8BEN?

The W-8BEN is to be completed by a nonresident alien who has received income that would normally be subject to U.S. tax withholdings. In simple terms, it’s completed by the foreign worker, not by the American business or employer. Foreign entities or those acting as an intermediary should not complete this form.

Generally, Form W-8BEN only gets filled out if requested by the payer (that’s you, the American employer), withholding agent, or foreign financial institution. Once completed, it is effective starting on the date signed and expires on the last day of the third following calendar year. However, if there are any changes in circumstances that make the information on the form incorrect, a new form is required within 30 days. A change in circumstances includes a move to the U.S. or to another foreign country.

What if the W-8BEN is not filled out as required?

If the form is not completed correctly, the foreign person could be subject to 30 percent federal tax withholding.

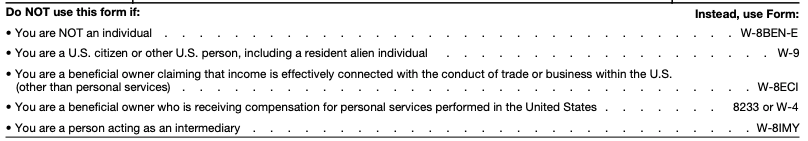

What’s the difference between a W-8BEN and other W-8 forms?

There are a number of W-8 forms, which can be confusing. Here’s a super quick overview of the W-8 form family:

| Form Type | Who should fill out the form |

| W-8BEN | The W-8BEN is for people who are claiming foreign status or tax treaty benefits. |

| W-8BEN-E | W-8BEN-E is for foreign entities that are claiming foreign status or tax treaty benefits. |

| W-8ECI | W-8ECI is for foreign individuals or entities that engage in business in the United States. |

| W-8IMY | W-8IMY is for intermediaries, such as flow-through entities, that are claiming tax benefits. |

| W-8EXP | W-8EXP is typically used by foreign governments and international organizations (among others) that are claiming a withholding tax exemption. |

What are the step-by-step instructions for filling out the W-8BEN?

Remember that the form should not be filed out by the American employer; it should be filled out by the worker who lives abroad.

You, the employer/payer, will be responsible for providing a copy of the form to the payee, but the contractor can also download it from the IRS website. The W-8BEN is a one-page form with seven pages of instructions.

If you want to help your contractor fill out the form, keep reading for some general step-by-step instructions, but know that it is best to read the IRS information and/or contact a tax professional to ensure compliance.

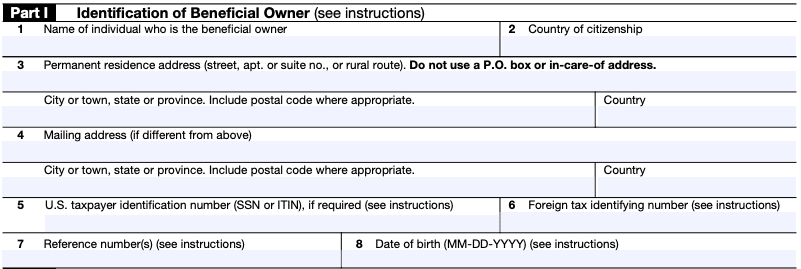

Completing Part I

Line 1 of the form asks for the name of the beneficial owner. This should be the name of the person who is filling out the form—the foreign worker who has received payment from an American payer.

Line 2 asks for the country of citizenship. If the contractor is a dual citizen, enter the country where the contractor is both a citizen and a resident. Fine print: U.S. citizens or resident aliens most likely must complete Form W-9 instead, even if the contractor holds dual citizenship in another jurisdiction. The W-8BEN is typically to be filled out only by an individual who is not a U.S. citizen or resident. There is even more fine print for this one, which includes single-owner disregarded entities. It’s best to advise those filling out this form to check with a CPA to ensure compliance.

Line 3 is the permanent residence address, including city, town, state, province, postal code, and country. The person filling out the form should not use a P.O. Box, financial institution, or care of address.

Line 4 is for the mailing address. This section should only be completed if the mailing address is different from the permanent residence address listed above.

Line 5 requests the U.S. taxpayer identification number, which could be a Social Security Number (SSN) or an individual tax identification number (TIN) if the contractor is a resident alien. An SSN or TIN must be provided if the contractor is claiming treaty benefits and/or a reduced withholding rate.

Line 6 requests a foreign tax identifying number.

Line 7 is requesting a reference number for the withholding agent. The contractor may include the number of the account to which payments are being made. In some cases, this line will be filed out by the withholding agent to reference an account or form that should be associated with this W-8BEN.

Line 8 asks for the date of birth of the contractor. This should be written in the month-day-year format as indicated (often residents or citizens of other countries will find this unusual because the month-day order is typically flipped outside the U.S.)

Completing Part II

This section should only be completed if the contractor is claiming treaty benefits as a resident of a foreign country with which the U.S. has an income tax treaty under Chapter 3 regarding withholding of tax on non-resident aliens and foreign corporations.

An updated list of these tax treaties can be found here.

Line 9 certifies that the country in which the contractor is a resident has a tax treaty with the United States.

Line 10 is only used to provide special rates or conditions for withholding tax between the U.S. and the resident country, along with a blank line to add any additional comments or explanations of eligibility for the special rate.

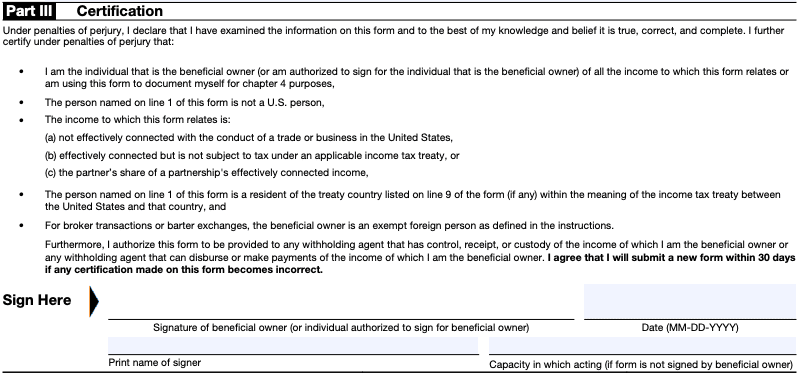

Completing Part III

This is the section where the foreign contractor (or an authorized person) signs and certifies that they are in fact not a U.S. person and the income to which this form relates was not earned or connected to a business that is located or conducted in the United States. It certifies that said income should not be subject to withholding tax or taxed at a special rate and that the contractor agrees to submit a new form within 30 days if any information on the document becomes incorrect.

Last, the contractor should sign and date the form.

Where should the contractor send the completed form W-8BEN?

Once completed, the contractor should not submit the form to the IRS. Instead, the form should be returned to you, the employer. Remind your contractor that because the form contains sensitive information, they want to make sure you are sending it securely.

If you have been provided with a completed W-8BEN by your contractor, it’s critical that you make every effort to safeguard the data just like you would any other sensitive document.