Barbara C. Neff | Published May 6, 2024 9 Min

The Inflation Reduction Act that was signed into law in August 2022 doubled the potential value of the Sec. 41 research and development (R&D) federal tax credit. Small businesses went from being able to save up to $250,000 to $500,00 on payroll taxes through the research credit. To take advantage of it, here’s what you need to know about IRS Form 6765, “Credit for Increasing Research Activities.”

What is Form 6765?

Form 6765 is a tax form from the Internal Revenue Service that helps qualified businesses to deduct basic research and similar costs from their taxes.

- Calculate and claim the R&D tax credit

- Elect to take a reduced credit (see below for more information on this election)

- Elect and calculate the payroll tax credit (see below).

The form includes four sections:

- Section A: to calculate the regular credit amount

- Section B: to elect the alternative simplified credit (ASC) and calculate the amount

- Section C: to determine the current year credit and where it should be reported

- Section D: to make the Qualified Small Business Payroll Tax election (see below) and calculate the amount

What is the R&D credit?

The credit provides incentives to US startups to pursue R&D work in the United States. It generally allows a business conducting “qualifying research” to apply a percentage of its qualifying expenses to offset, on a dollar-for-dollar basis, its federal income tax liability (whether regular income tax or, for eligible small businesses, the alternative minimum tax). You also may be able to apply it to your payroll tax liability (see below for more information).

There’s no limit on how large of a credit you can claim each year to offset income tax liability. Unused credits can be carried forward for 20 years or back one year to offset tax liability.

You can also file an amended return to retroactively claim R&D expenses incurred in the previous three years.

Am I eligible for the R&D credit?

The credit is generally available to businesses of any size, in any industry, that work to develop new products or processes—even if they don’t ultimately succeed in their endeavors. Many eligible taxpayers neglect to claim the credit, though, likely due to misconceptions about the types of research that qualify.

The IRS has a four-part test for qualifying research activities:

- The research is performed to eliminate technical uncertainty about the development or improvement of a product or process, including computer software, techniques, formulas, and inventions.

- The research is undertaken to discover information that’s technological in nature (that is, it relies on physical, biological, engineering, or computer science principles).

- The research is intended for use in developing a new or improved business product or process.

- Substantially all of the research activities—generally, at least 80 percent—are elements of a process of experimentation relating to a new or improved function, performance, reliability, or quality.

If you’ve conducted such research, you’re probably eligible for the credit.

What is qualified research?

Qualified research includes services rendered to conduct research and development for making technological discoveries for each business component of the taxpayer related to a new or improved function, performance, reliability, or quality. Essentially, expenditures can be treated as section 174 expenses (i.e., under Internal Revenue Code Sec. 174).

The instructions for the 6765 form also cover that the research credit generally can’t be applied in these instances:

- Research conducted after the beginning of commercial production

- Research adapting an existing product or process to a particular customer’s need

- Duplication of an existing product or process

- Surveys or studies

- Research relating to certain internal-use computer software

- Research conducted outside the United States, Puerto Rico, or a US territory

- Research in the social sciences, arts, or humanities

- Research funded by another person (or governmental entity)

Who should file Form 6765?

Partnerships, C corporations, S corporations, and sole proprietors must file the form to claim the credit. For pass-through entities, the credit passes through to the individual level on Schedule K-1, with the individual reporting the credit on their Form 3800, “General Business Credit.” C corporations and sole proprietors file both Form 6765 and Form 3800 with their tax returns.

Should I bother filing if my business doesn’t have income tax liability?

Absolutely. For one thing, the credit can be carried back one year or forward 20 years—you likely will have the chance to use it at one point or another.

Moreover, you may also have the option to apply some or all of the credit against your payroll tax liability, which can substantially boost your cash flow. The Protecting Americans from Tax Hikes (PATH) Act of 2015 created this option to incentivize R&D by early-stage companies that hadn’t yet incurred income tax liability.

Specifically, under the PATH Act, eligible businesses can elect to apply up to $250,000 of the credit against their 6.2% share of the Social Security taxes for their employees. You qualify if you have:

- Gross receipts of less than $5 million for the tax year, and

- No gross receipts for any tax year preceding the five-tax-year period (ending with the current tax year).

If the tax year is shorter than 12 months, your gross receipts must be prorated for an entire year. For example, if you had gross receipts of $1 million in a three-month tax year, your gross receipts for that year are $4 million ([12/3] x $1 million).

The Inflation Reduction Act of 2022 extended the payroll tax option. Eligible businesses are able to apply an additional $250,000 of their R&D credit against their 1.45% Medicare tax liability.

So the total maximum payroll tax credit is $500,000. The amount is bifurcated, though. That means you can apply no more than $250,000 against each prong of payroll tax liability—Social Security and Medicare. You can’t, for example, use $400,000 against Social Security and $100,000 against Medicare.

What types of information will I need to complete the form?

You’ll need to track your qualifying expenses. Those generally include:

- Taxable wages for employees involved with the research

- Supplies to conduct the research (for example, supplies used for prototypes)

- Amounts paid to rent or lease computers to conduct the research (including cloud services)

- A portion of the amounts paid or incurred for contractors to work in the United States on the research (usually 65 percent)

How does the form calculate my credit?

You’ll complete either Section A (for the regular credit) or Section B (for the ASC). While it’s wise to do the math for both to determine which is more valuable, you should only complete the portion that applies to the type of credit you choose.

The regular credit equals 20 percent of all qualifying expenses for the current year that exceed a specified base amount. In other words, it’s not 20 percent of all of your qualifying expenses. Determining the base amount can require some detailed calculations.

For that reason, you might prefer the ASC. The ASC is generally easier to calculate but produces a smaller credit.

Note: If you choose to go with the ASC, your election will apply to the current tax year and all subsequent years. You can’t revoke a current year’s election, but you can revoke the election for a later year. You’ll need to complete Section A and attach Form 6765 to your original tax return for the year the revocation will apply.

Why would I want to take a reduced credit?

At the end of both Section A (line 17) and Section B (line 34), you’re given the option to take a reduced credit by making what’s known as a 280C election. It might seem odd not to claim the full amount, but it could make sense.

That’s because, if you take the full credit, you have to reduce your otherwise allowable Sec. 174 deduction for qualified research expenses by the amount of the credit.

In other words, you have to add the full credit amount to your taxable income before you apply the credit—which could push you into a higher tax bracket. You don’t have to add the reduced credit amount to your taxable income when you take the reduced credit.

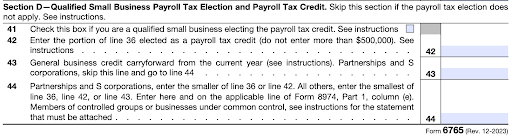

Do I need to complete Section D?

You need only fill out Section D if you’re making the payroll tax election. If you are, and you’re a qualified small business other than a partnership or an S corporation, you first must complete Form 3800.

In the current version of Form 6765, you must enter the portion of your research credit that you’re claiming as a payroll tax credit, not to exceed $500,000—up to $250,000 against Social Security taxes and up to $250,000 against Medicare taxes.

Section D also requires taxpayers that aren’t a partnership or S corporation to calculate their business credit carryforward for the current year, based on information from Form 3800. The ultimate credit will be the smallest of either:

- The current year R&D credit

- An elected amount not to exceed $500,000 (split evenly between Social Security and Medicare taxes)

- The general business credit carryforward for the current year (before applying for the payroll tax credit)

How do I apply the credit against my payroll taxes?

You must complete Form 8974, “Qualified Small Business Payroll Tax Credit for Increasing Research Activities,” and attach it to your employment tax return.

You can apply the credits to offset payroll taxes no sooner than the first quarter after you file the tax return where you make the payroll tax election. The credit can’t exceed the amount of tax imposed for any calendar quarter; unused amounts can be carried forward.

How do I file Form 6765?

Attach the form to your income tax return. In addition to Form 6765, Form 3800 is used to report general business credits, which include the R&D credit, and may need to be filed on the tax return for which the R&D credit will be claimed.

For the payroll tax offset and the 280C election mentioned above, both must be reported on Form 6765 and timely filed to be effective, so neither election can be made on an amended tax return or a late filing.

Are there any risks I should know about?

Form 6765 can be complicated, especially when determining which expenses qualify. As a result, you could over- or understate the qualifying expenses. And if you claim a large credit, you could draw the attention of the IRS and end up in a tax audit. Likewise, the specifics of the R&D tax credit may change from year to year, so we recommend working with a CPA or tax professional to minimize the risks.