Andi Smiles | Published Mar 5, 2021 12 Min

Update as of May 5, 2021:

Funding for PPP has run out for all lending institutions with the exception of CDFIs. Funding remains solely for community lenders.

It’s back! The next round of PPP loans are here and funds are available for first- and second-time borrowers. Applications for PPP loans are open until March 31, 2021, so don’t wait on applying for a loan.

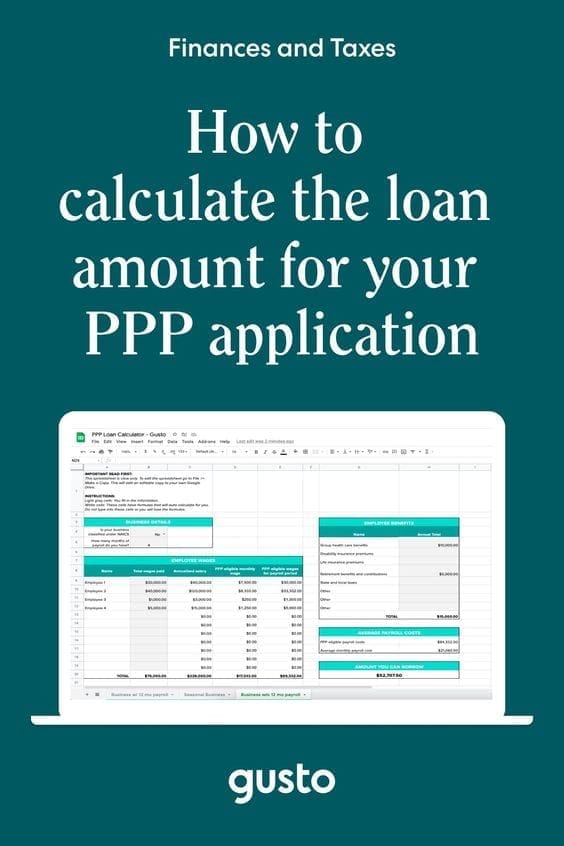

Figuring out the loan amount to apply for can be complicated: there are requirements that must be met and calculations that must be made. We show you how to do it below and provide a handy PPP Loan Calculator tool to help.

What’s new with PPP loans

A lot has changed when it comes to PPP loan requirements. To get the details on eligibility, the covered period, tax-deductibility, and how to apply for forgiveness, see this comprehensive guide on PPP round 2. But, we’ll give you the quick version below:

New application forms were released on March 3, 2021

There are eight—that’s right, eight!—versions of the PPP first-draw application form, and three versions of the second-draw form. It’s best to use the latest versions, which is what we have linked in the bullets below:

- First-draw PPP borrowers (those borrowing a PPP loan for the first time) who don’t file Form 1040 Schedule C should use this form.

- Second-draw PPP borrowers (those borrowing a second PPP loan) who don’t file Form 1040 Schedule C should use this form.

- First-draw PPP borrowers (those borrowing a PPP loan for the first time) who do file Form 1040 Schedule C and elect to use gross income to make the loan maximum calculation should use this form.

- Second-draw PPP borrowers (those borrowing a second PPP loan) who do file Form 1040 Schedule C and elect to use gross income to make the loan maximum calculation should use this form.

(We’ll get into more details below about the calculation differences between different entity types. Stay tuned!)

Who qualifies for a second-draw loan?:

If you’re interested in borrowing a second PPP loan, it’s best to check that comprehensive PPP guide we mentioned above for all the details—but the short version is, the following businesses are eligible:

- Those who have under 300 full-time, part-time, or seasonal employees

- Those who have used or allocated the full amount of the first-draw PPP loan

- Businesses that can demonstrate they have experienced a revenue reduction of at least 25 percent

See this step-by-step guide on applying for a second-draw PPP loan and calculating the 25 percent revenue reduction.

Covered period

Previously, borrowers were required to select either an 8-week or 24-week covered period. Now, new borrowers may select any period between 8 and 24 weeks as their covered period. If you have an existing PPP loan from the first round, your covered period will stay the same.

Tax-deductibility of PPP forgivable expenses

The new bill clarifies that expenses paid for using PPP money are tax-deductible, and the loan is not counted as income, so it will not be taxed. This applies to current and future loans.

Loan forgiveness

Borrowers with loans less than $150,000 will have a new, one-page application for forgiveness. Borrowers will not be required to submit documentation and, instead, will be asked to certify the number of employees that were retained due to their PPP loan, the estimated amount spent on payroll costs, and the total loan value.

Expenses eligible for forgiveness

If you want your loan to be forgiven, this round of PPP loans (whether you’re taking a first- or a second-draw loan) still requires that you spend at least 60 percent of the loan on payroll costs like wages, benefits, and insurance costs. Group health, dental and vision insurance are now included in payroll costs, and life and disability insurance costs have also been added as eligible payroll expenses.

The remaining 40 percent of your PPP loan can still be used to pay for mortgage interest, rent, and utilities (like electricity, gas, water, transportation, telephone, or internet access), plus new eligible expenses.

Self-employed individuals who have no employees and file Form 1040, Schedule C may use PPP proceeds on the following expenses:

- If the PPP loan amount has been calculated using net profit, then owner compensation is an eligible expense

- If the PPP loan amount has been calculated using gross income, then proprietor expenses (business expenses plus owner compensation) are eligible.

- Mortgage interest

- Rent

- Utility payments

- Interest payments on any debt incurred before February 15, 2020 (keep in mind that these expenses will not be eligible for forgiveness)

- Costs related to business operations

- Certain property damage costs

- Supplier costs

See these tables for a complete view of eligible expenses for PPP forgiveness.

Calculate how much you can borrow from PPP

To calculate the PPP loan amount you can borrow,

see this PPP Loan Calculator.

You’ll notice that sample amounts appear in the calculator. To edit and include amounts relevant to your business, make a copy (go to File → Make a Copy), and replace the amounts.

The PPP loan maximum for first-draw borrowers is 2.5 times your average monthly payroll costs (which include healthcare costs) for 2019 or 2020, up to $2 million.

Certain second-draw borrowers can borrow 3.5 times the average monthly payroll costs. Those second-draw borrowers must own businesses that are classified under Code 72 by the North American Industry Classification System (NAICS). The types of businesses that fall under Code 72 are businesses that provide lodging and accommodations or meals, snacks, and beverages for immediate consumption.

Your key takeaway: all first-draw borrowers can borrow 2.5 times payroll costs; most second-draw borrowers can also borrow 2.5 times payroll costs. Only a small segment of second-draw borrowers will be eligible to borrow 3.5 times payroll costs.

Got it?

How do the loan calculations differ for first and second-draw loans?

They don’t. However, as we mentioned above, eligibility for second-draw loans requires that you demonstrate at least a 25 percent loss in revenue. This means second-draw loan applicants must do two different calculations:

- A calculation to show the 25 percent revenue reduction (click on that link for step-by-step instructions on how to do that)

- A loan amount calculation (we’ll show you how to do that in this post)

Employers with 12 months of payroll

The amount you can borrow is based on your average monthly payroll costs for 2019 or 2020. So, the first step is adding up your payroll costs for either year (you get to choose which).

Payroll costs include:

- Employee wages, salaries, commissions, or tips

- Payment for vacation, parental, family, medical or sick leave

- Group health care benefits, which include group health, dental and vision premiums, and disability and life insurance premiums

- Retirement benefits, like employer contributions

- State and local taxes assessed on employee compensation

In the PPP Loan Calculator, you’ll see line items for each of these payroll costs; simply enter

Once you know your total annual payroll costs, you’ll simply divide that number by 12 to calculate your average monthly payroll costs. Here’s an example:

| Description | Annual Payroll Cost |

| Employee wages | $200,000 |

| Group health care benefits | $50,000 |

| Retirement benefits and contributions | $20,000 |

| Total annual payroll costs | $270,000 |

| Average monthly payroll cost | $22,500 |

You’ll need to exclude any employee wages over $100,000 from your monthly payroll costs. So, if you pay an employee $120,000 per year, you can only count $100,000 of their wages in your total payroll costs. Here’s how this looks.

| Description | Annual Payroll Cost | PPP Eligible Payroll Cost |

| Employee #1 | $120,000 | $100,000 |

| Employee #2 | $50,000 | $50,000 |

| Employee #3 | $30,000 | $30,000 |

| Group health insurance | $50,000 | $50,000 |

| Retirement benefits and contributions | $20,000 | $20,000 |

| Total annual payroll costs | $270,000 | $250,000 |

| Average monthly payroll cost | $22,500 | $20,833 |

The last step is to multiply your average monthly payroll cost by 2.5 or 3.5. Let’s assume your business is eligible for 2.5 times payroll costs.

$20,833 x 2.5 = $52,082

You can borrow up to $52,082.

Employers without 12 months of payroll

As long as your business was operational by February 15, 2020, you can still apply for a PPP loan without 12 months of payroll.

To apply, you’ll calculate your total payroll costs up to February 15, 2020. Keep in mind, that businesses without 12 months of payroll still need to exclude any wages that would equal more than $100,000 annualized (see the seasonal business calculation for an example of how this works).

Then, you’ll divide your total payroll costs by the total number of months you’ve been in business. For example, if your total payroll costs were $30,000 and you were in business for three months, it would look like this:

$30,000 / 3 = $10,000

Your average monthly payroll $10,000. From here, you’ll multiply this number by 2.5 or 3.5.

$10,000 x 2.5 = $25,000

You can borrow $25,000.

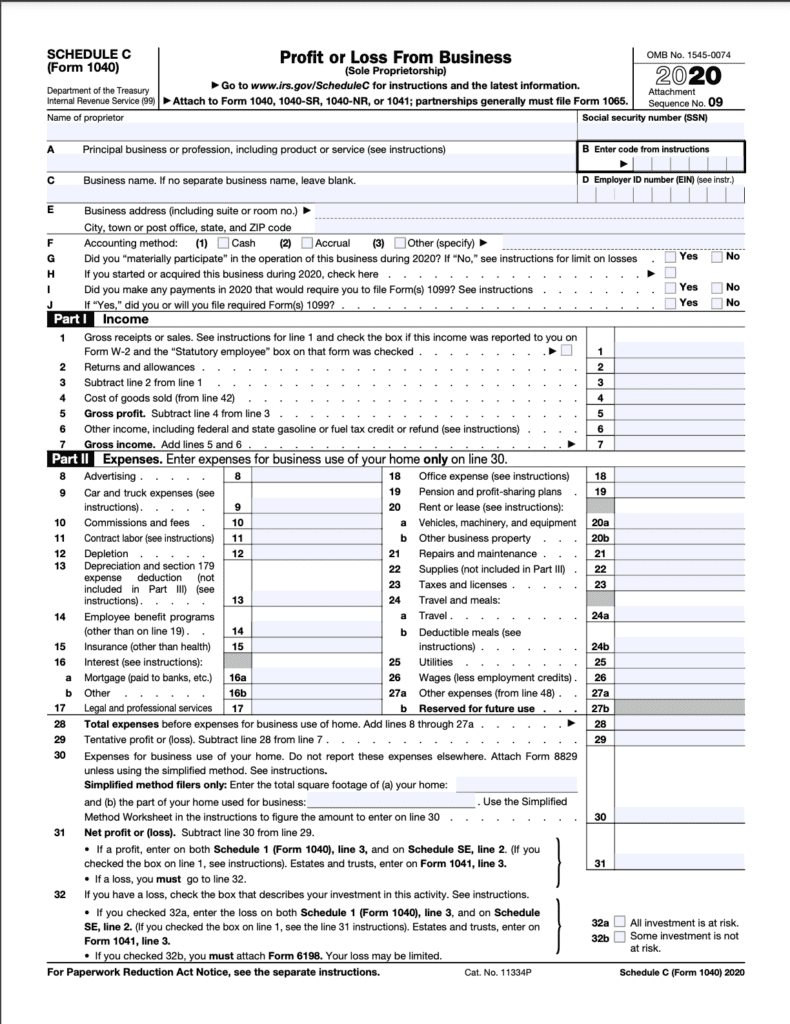

Self-employed borrowers (with or without employees) who file Form 1040, Schedule C

A new rule (released on March 3, 2021) enables self-employed borrowers who fill out Form 1040, Schedule C to calculate the PPP loan amount based on either gross income or net profit. The reason this change was made was to help self-employed folks get larger PPP loans.

This change is not retroactive.

That means that if you have already submitted your PPP application and made the calculation based on net profit—and that loan has been approved—you cannot go back and modify your loan maximum.

Not sure which forms you fill out? This handy table can guide you.

Don’t know what Form 1040, Schedule C looks like? Here’s a screenshot (the actual form is 2 pages):

You can find net profit on line 31 of the form, and you can find gross income on line 7 of the form.

And now, onto the calculation . . .

If you file form 1040, Schedule C, and have no employees

Step 1: Fish out your 2019 or 2020 Form 1040, Schedule C form. Choose one of these forms to make the calculation. (If you haven’t filled out the 2020 form yet, you can fill it out now to make these calculations.)

Step 2: Decide if you want to use net profit (found on line 31) or gross income (found on line 7) to make the calculation. Two important things to consider:

- The larger number will lead to a larger loan maximum, so have a good understanding of whether that’s what’s best for your business.

- If your gross income is over $150,000 and you use gross income to make your calculation, you will be excluded from safe harbor.

Step 3: Once you have made your selection (either net profit or gross income), if the amount is over $100,000, reduce it to $100,000; you are restricted from using an amount larger than this to make your calculation.

Step 4: From here, the process is simple. Divide the amount you’ve chosen (either net profit or gross income) by 12. For example, let’s say you’ve elected to use gross income and you see on line 7 of your form that your gross income is $90,000, you would do this:

$90,000 / 12 = $7,500

Your average monthly gross income is $7,500.

Step 5: Now, you’ll multiply that number by 2.5 or 3.5 (depending on your business type). Continuing with the example we started in Step 4, let’s assume your business type allows for 2.5 times your gross income:

$7,500 x 2.5 = $18,750

You can borrow $18,750.(Keep in mind that this amount cannot exceed $20,833.)

Step 6: This only applies to those who have received EIDL funds; if you have and want to refinance those funds, add that amount for your loan calculation maximum. EIDL advance grants are excluded from this; only loan money is eligible to be added.

If you file form 1040, Schedule C, and have employees

Step 1: Fish out your 2019 or 2020 Form 1040, Schedule C form. Choose one of these forms to make the calculation. (If you haven’t filled out the 2020 form yet, fill it out now to make these calculations.)

Step 2: Decide if you want to use net profit (found on line 31) or gross income (found on line 7) to make the calculation.

Two important things to consider:

- The larger number will lead to a larger loan maximum, so have a good understanding of whether that’s what’s best for your business.

- If your gross income is over $150,000 and you use gross income to make your calculation, you will be excluded from safe harbor.

Step 3: If you choose to use gross income, you must subtract proprietor expenses. Find the expenses listed on lines 14, 19, and 26 on your 1040 Schedule C form and subtract them from the gross income amount.

Gusto customers can easily find these numbers by pulling reports.

Step 4: If the amount is over $100,000, reduce it to $100,000; you are restricted from using an amount larger than this to make your calculation.

Step 5: Divide that number by 12 to get your monthly gross income.

Step 6: Calculate your monthly payroll costs. Payroll costs include:

- Employee wages, salaries, commissions, or tips

- Payment for vacation, parental, family, medical or sick leave

- Group health care benefits, which include group health, dental and vision premiums, and disability and life insurance premiums

- Retirement benefits, like employer contributions

- State and local taxes assessed on employee compensation

You’ll need to exclude any employee wages over $100,000 from your monthly payroll costs. So, if you pay an employee $120,000 per year, you can only count $100,000 of their wages in your total payroll costs. Here’s how this looks.

| Description | Annual Payroll Cost | PPP Eligible Payroll Cost |

| Employee #1 | $120,000 | $100,000 |

| Employee #2 | $50,000 | $50,000 |

| Employee #3 | $30,000 | $30,000 |

| Group health insurance | $50,000 | $50,000 |

| Retirement benefits and contributions | $20,000 | $20,000 |

| Total annual payroll costs | $270,000 | $250,000 |

| Average monthly payroll cost | $22,500 | $20,833 |

Step 7: Add your monthly gross income (what you calculated in Step 5) to your monthly payroll costs (what you calculated in Step 6).

Step: 8: Now, you’ll multiply that number by 2.5 or 3.5 (remember: only second-draw borrowers with very specific business types can multiply by 3.5 depending on whether your business type).

Seasonal employers

For seasonal employers, borrowers can elect to use any 12-week period between February 15, 2019 and February 15, 2020 to calculate their average monthly payroll.

Instead of dividing the total payroll costs by 12, you’ll divide the total by 3.

For example, if your total payroll for the 12 week period is $42,000, it would look like this.

$42,000 / 3 = $14,000

Your monthly average payroll is $14,000.

Seasonal businesses still need to exclude employee wages that are more than $100,000 annualized. In other words, even if you didn’t pay your employee more than $100,000 during the 12-week period, if their seasonal wages would equal more than $100,000 over 12 months, then the amount over $100,000 is excluded.

For example, if you paid an employee $30,000 in a 12-week period, over the course of a year that would equal $120,000. When calculating your average payroll costs, it would look like this:

| Description | 12 week total | Annual equivalent | PPP Eligible Monthly Wage | PPP Eligible Wage for 12-week period |

| Employee #1 | $30,000 | $120,000 | $8,333 | $24,999 |

| Employee #2 | $9,000 | $36,000 | $3,000 | $9,000 |

| Employee #3 | $3,000 | $12,000 | $1,000 | $3,000 |

The last step is to multiply your average monthly payroll cost by 2.5 or 3.5.

$14,000 x 2.5 = $35,000

You can borrow $35,000.

If you’re looking for support with calculating how much you can borrow, don’t forget to check out the PPP Loan Calculator.