You may have heard about the Employee Retention Credit (ERC), but can’t figure out if your business is eligible to receive it. The rules are complicated, but we’ll walk you through how to determine whether you qualify, and you can use this handy Eligibility Calculator to help you with the Gross Receipts Test … but we’re getting ahead of ourselves. Let’s dive into ERC eligibility and (fingers crossed!) help you collect some serious tax credits.

What time periods are ERC eligible?

While certain legislators are vying to make ERC permanent, as of right now, it’s a temporary tax credit that can be applied to wages and health plan expenses paid out within these timeframes only:

2020

- Q2 2020: March 13, 2020 – June 30, 2020 (It may seem strange that part of March is included in this time period, as March is typically considered part of the first quarter but for the sake of ERC, Q2 starts on March 13, 2020)

- Q3 2020: July 1, 2020 – September 30, 2020

- Q4 2020: October 1, 2020 – December 31, 2020

2021

- Q1 2021: Jan 1, 2021 – March 31, 2021

- Q2 2021: April 1, 2021 – June 30, 2021

- Q3 2021: July 1, 2021 – September 30, 2021

- Q4 2021 – Recovery Startup Businesses ONLY: October 1, 2021 – December 31, 2021; in this period the vast majority of small businesses will not be eligible for ERC. The only businesses eligible for ERC in Q4 of 2021 are Recovery Startup Businesses (those businesses that started after February 15, 2020 and have gross receipts totaling less than $1M).

Does my business qualify for ERC for 2020?

You qualify for ERC for Q2, Q3, and/or Q4 2020 if the following conditions are met:

| Your business was in operation before February 16, 2020 | You had fewer than 501 W2 employees in the qualifying quarter |

Either: Your business was subject to a partial or full government shutdown order, AND/OR: You pass the Gross Receipts Test for the qualifying quarter by demonstrating a loss of 50 percent or more. To know if you pass the Gross Receipts Test, use the ERC Eligibility and Credit Calculator; keep reading to learn how to use the calculator |

How to use the ERC Eligibility Calculator to determine if you qualify in 2020

1. Go to the Calculator.

2. Click File > Make a Copy at the top right hand of your screen. Now you have your own version of the calculator.

3. Click on the tab at the bottom that is labeled 2020.

4. Only change values in the light grey cells; do not change any of the values in the cells that are white, because those cells contain formulas, and altering the formulas will cause your calculations to result in errors. The content that appears in the light grey cells is simply example content, feel free to remove and alter it to values relevant to your business.

5. Choose the appropriate quarters enter your information:

6. The calculator will reveal whether you are qualified for ERC. If you are qualified, move on to the the ERC Credit Calculation lower down in the spreadsheet (this post walks you through how to use it and calculate your credit).

Still confused? Check out this decision tree:

What if my business was formed in the middle of a quarter in 2019?

Easy peasy. Simply estimate the gross receipts it would have had for the entire quarter based on the gross receipts for the portion of the quarter that the business was in operation.

To calculate this amount, use any reasonable method, like extrapolating the gross receipts for the quarter based on the gross receipts for the number of days the business was operating.

When does ERC eligibility end for 2020?

Eligibility ends on the earlier of these two dates:

- January 1, 2021 (you may be eligible for ERC in 2021, but eligibility rules change in 2021, so keep reading to learn more about that)

- The quarter following a quarter in which gross receipts loss is greater than 80 percent.

For example, if your business experienced a loss of 85 percent in Q3 of 2020 but only a 5 percent loss in Q4 of 2021, you still qualify for ERC in Q3 and Q4, because Q4 follows a quarter in which losses were greater than 80 percent.

Does my business qualify for ERC for 2021?

In 2021, eligibility rules change (as if things aren’t confusing enough), so here’s what you need to know.

Q1 and Q2 2021 ERC eligibility

You qualify for ERC for Q1 and/or Q2 of 2021 if the following conditions are met:

| Your business was in operation before February 16, 2020 | You had fewer than 501 W2 employees in the qualifying quarter |

Either: Your business was subject to a partial or full government shutdown order, AND/OR: You pass the Gross Receipts Test for the qualifying quarter by demonstrating a loss of 20 percent or more. To know if you pass the Gross Receipts Test, use the ERC Eligibility and Credit Calculator; keep reading to learn how to use the calculator |

How to use the ERC Eligibility Calculator to determine if you qualify in Q1 and/or Q2 2021

1. Go to the Calculator.

2. Click File > Make a Copy at the top right hand of your screen; now you have your own version of the calculator.

3. Click on the relevant tab at the bottom of the spreadsheet:

- If you are assessig Q1, click on the tab with that label.

- If you are assessig Q2, click on the tab with that label.

4. Only change values in the light grey cells; do not change any of the values in the cells that are white, because those cells contain formulas, and altering the formulas will cause your calculations to result in errors. The content that appears in the light grey cells is simply example content, feel free to remove and alter it to values relevant to your business.

5. In Rows 3 – 5, review whether you were subject to a government shutdown order:

6. If the answer is Yes, continue to the ERC Credit Calculation below, if the answer is No, continue to the sections on Decline in Gross Receipts.

7. If your business was in operation in the corresponding quarter of 2019 and you have gross receipts from that quarter, use Rows 7 – 11 to determine your loss:

8. If the answer is Yes, continue to the ERC Credit Calculation, if the answer is No, try the Alternate Period in Rows 19 – 23 (detailed in Step 11 below).

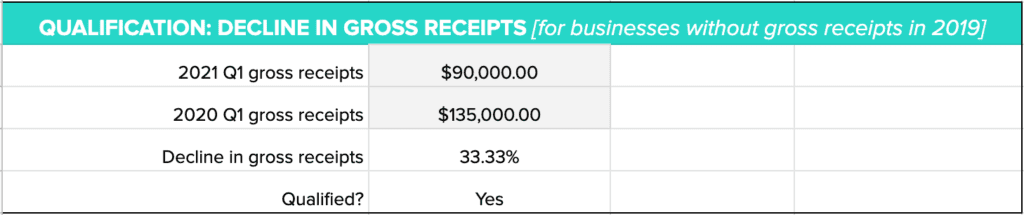

9. If your business was not in operation in 2019 and you only have gross receipts from 2020, use Rows 13 – 17 to compare quarters from 2020 with corresponding qaurters 2021 to determine the Decline in Gross Receipts:

10. If the answer is Yes, continue to the ERC Credit Calculation below; if the answer is No, try the Alternate Period in Rows 19 – 23 (detailed in Step 11 below).

11. You can also use an Alternate Period (in Rows 19 – 23) to make your calculation; to do this compare, the quarter immediately preceding the one you are calculating for.

This means if you are assessing eligibility in Q1, you can compare Q4 of 2020 to Q1 of 2021; if you are assessing eligibility in Q2, you can compare Q1 of 2021 to Q2 of 2021.If you get a Yes, move on the ERC Credit Calculation below; if the answer is No, try another quarter.

Still can’t figure out if you’re eligible? See this decision tree:

Q3 and Q4 2021 ERC eligibility

When it comes to qualifying for ERC, IRS rules and regulations are still pending for the third and fourth quarters of 2021. Here’s what we know so far . . . you will likely qualify for ERC for Q3 and/or Q4 of 2021 if the following conditions are met (within the qualifying quarter):

| Your business was in operation before February 16, 2020 | You had fewer than 501 W2 employees in the qualifying quarter, or you qualify as a Severely Distressed Employee |

Either: Your business was subject to a partial or full government shutdown order, AND/OR: You pass the Gross Receipts Test for the qualifying quarter by demonstrating a loss of 20 percent or more. If you experience a loss of 90 percent or more, you qualify as a Severely Distressed Employer and may be eligible for the credit even if you have over 500 employees. To know if you pass the Gross Receipts Test, use the ERC Eligibility and Credit Calculator; keep reading to learn how to use the calculator. |

How to use the ERC Eligibility Calculator to determine if you qualify in Q3 and Q4 of 2021

1. Go to the Calculator.

2. Click File > Make a Copy at the top right hand of your screen; now you have your own version of the calculator.

3. Click on the relevant tab at the bottom of the spreadsheet:

- If you are assessing Q3, click on the tab with that label

- If you are assessing Q4, click on the tab with that label

4. Only change values in the light grey cells; do not change any of the values in the cells that are white, because those cells contain formulas, and altering the formulas will cause your calculations to result in errors. The content that appears in the light grey cells is simply example content, feel free to remove and alter it to values relevant to your business.

5. In Rows 3 – 5, review whether you were subject to a government shutdown order:

6. If the answer is Yes, continue to the ERC Credit Calculation below, if the answer is No, continue to the sections on Decline in Gross Receipts.

7. Compare the corresponding quarter in 2019 with the one in 2021, use Rows 7 – 12 to determine your loss. If the Decline in Gross Receipts is over 20 percent, you qualify for ERC. If the decline is over 90 percent. you qualify as a Severely Distressed Employee, and may be eligible for the credit even if you have more than 500 employees:

8. If the answer next to Qualified? is Yes, continue to the ERC Credit Calculation, if the answer is No, you do not qualify for this quarter.

9. See this post to determine how to calculate your ERC amount.

I received PPP, is my business still eligible for ERC?

Yep. If you received PPP or EIDL funds you are still eligible for ERC—however, wages that were paid out with either PPP or EIDL funds are not eligible for ERC, so be sure that when making your ERC calculation to determine how much credit you will receive, you only calculate wages that were not paid with PPP or EIDL funds. We get into all of that in the post on how to calculate your credit, so be sure to check it out.